Innovative, non-traditional competitors and evolving regulatory environments are impacting sectors from healthcare to manufacturing to financial services. No industry is immune to these dynamic economic, compliance, and operating conditions. OPPiDEA gives you the sector intelligence and insights you need to successfully navigate market transformations and compete confidently.

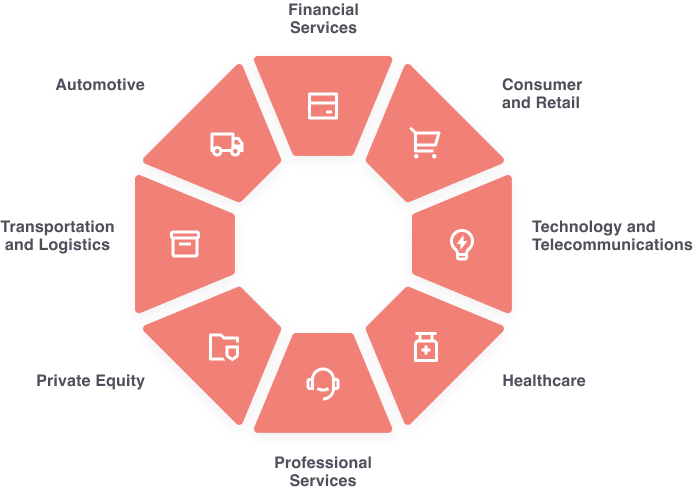

OPPiDEA’s sector intelligence spans eight key industries. Our ability to clearly understand trends, pain points, and perspectives far exceeds anything you’d receive from off-the-shelf research and superficial insights. After baseline scoping and sizing of the sector, we then identify unique themes, trends, and forecasts that affect your business. By using a consistent approach across all focus sectors, we can more quickly synergize insights, identify white spaces, and build a holistic view of emerging multi-sector markets such as FinTech, e-commerce, and taxi e-hailing.

With OPPiDEA, you gain an insight-backed, sector-specific edge on the new normal.

Whether you are a traditional industry player—looking to leverage digital technologies or respond to evolving market or regulatory challenges—or you are an emerging player, trying to better understand sector dynamics to carve out a larger share of wallet, OPPiDEA is your one-stop shop for sector intelligence and insights.

![]()

Whether you are a

traditional industry player—looking to leverage digital technologies or respond to evolving market or regulatory challenges—or you are an emerging player, trying to better understand sector dynamics to carve out a larger share of wallet, OPPiDEA is your one-stop shop for sector intelligence and insights.

![]()

Sector Expertise

Here are some highlights from OPPiDEA’s sector research

Automotive

Evolving regulatory, technology, consumer, and social demands are setting the stage for one of the most disruptive periods in automotive manufacturing history. Electric vehicles, self-driving cars, vehicle connectivity, ridesharing, and other new business models are redefining mobility, introducing new market entrants, and rapidly changing industry dynamics.

Financial Services

Digitalization and evolving regulatory requirements continue to transform the financial services sector. FinTech and social platform companies are encroaching on traditional banks and insurance firms, building online marketplaces that offer cutting-edge payment, processing, and wallet capabilities, not to mention robotics-based investment advisory services. Traditional banks relying on customer loyalty and legacy product profitability will lose ground to the smaller, but more innovative and faster growing new market entrants.

Consumer and Retail

Digital solutions continue to transform retail—from CPG manufacturers and distributors that use IoT and AI backed “factory-as-a-service” to the continued battle between brick and click. Lines are blurring as online retailers move into physical spaces, while brick-and-mortar retailers invest in a more robust online presence and use mobile technology to enhance their customer experience strategies.

Technology

Anything ‘as-a-service’ is the new normal. Tech companies are pivoting away from a product-centric focus to one built on business relevance—expanding their product and service offerings to include cloud, AI, and IoT—and participating in industry mashups, such as telehealth, FinTech, and Industry 5.0.

Telecom

In addition to building out their core voice and data services business, telecom service providers must redefine infrastructure, services, and platforms to compete against asset-light streaming and over-the-top (OTT) businesses. Other priority investments include environmental, social, and governance (ESG) initiatives and 5G migration.

Healthcare

Technology innovation is transforming the entire healthcare value chain—from manufacturing of medical equipment that leverages IoT, AI, and smart tag-based logistics to healthcare delivery utilizing telehealth and consumer apps. At the same time, healthcare organizations are challenged with interoperability of eHealthcare technologies and hardware, cyber security, and ongoing regulatory compliance.

Professional Services

While continuing to identify and optimize specialized skillsets, professional services firms are increasingly looking to augment those billable hours with technology-driven solutions. Another emerging trend is the focus on moving and monetizing intangible assets such as technology, intellectual property, and customer networks onto digital platforms.

Private Equity

Macroeconomic levers are causing private equity firms to redefine investment success while ensuring the overall asset class outperforms public markets. Governments are adjusting fiscal and monetary policies to make their markets more attractive to private equity firms by aligning them closer to the view of the street. Finally, increased scrutiny from regulators, auditors, and investors are requiring transparent, consistent, and well-documented valuation.

Transportation and Logistics

Online logistics and supply chain platforms are helping optimize procurement decisions and reduce overall supply chain costs. Emerging trends to watch include drone-based last mile delivery and innovative fifth-party logistics (5PL) which are blurring traditional service provider boundaries and using e-businesses to further reduce costs.